springfield mo sales tax rate 2020

The Missouri sales tax rate is currently. Review the sales tax benchmarks.

Monthly Financial Reports Springfield Mo Official Website

840 Boonville Avenue Springfield MO 65802 Phone.

. The December 2020 total local sales tax rate was also 8100. Statewide salesuse tax rates for the period beginning July 2020. Statewide salesuse tax rates for the period beginning July 2021.

What is the sales tax rate in Springfield Missouri. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. For tax rates in other cities see Missouri sales taxes by city and county.

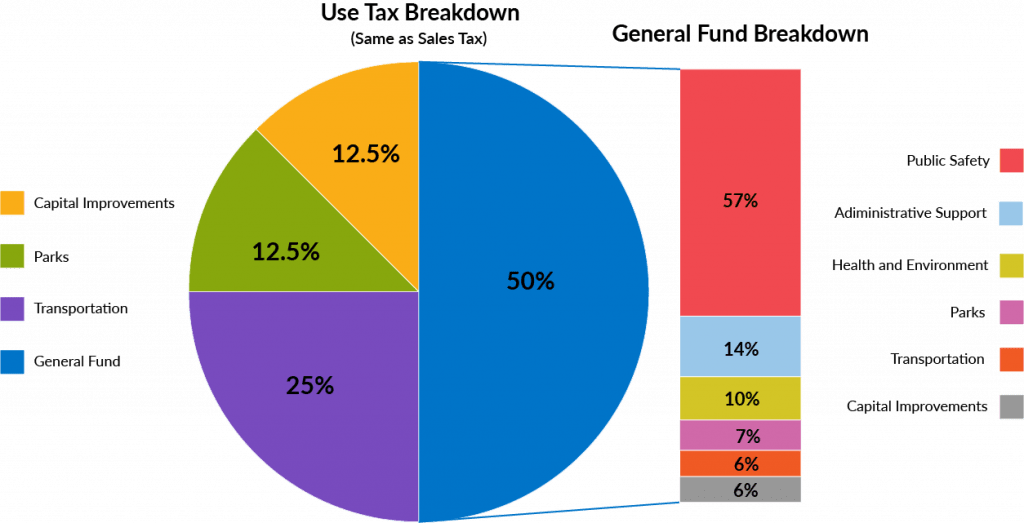

The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education 10 percent and ParksSoils 010 percent. 6152020 Taxation Division TA0300 Sales and Use Tax Rate Tables Display Only Changes. Comes from sales tax and use tax.

27733513 ACTUAL JANUARY FY 2020. For other states see our list of nationwide sales tax rate changes. 052020 - 062020 - PDF.

Budget FY19 Actual FY20 Actual. Compared to last years actuals revenues are up nearly 129 on a year-to-date basis. Raised from 66 to 8725.

Statewide salesuse tax rates for the period beginning November 2020. Springfield mo sales tax rate 2020 Saturday March 12 2022 Edit. Raised from 6225 to 8725 Meadville Linneus Wheeling Sumner Purdin and Chula.

Springfield collects a 3375 local sales tax the maximum local sales. Select the Missouri city from the list of popular cities below to see its current sales tax rate. The County sales tax rate is.

The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax. There are a total of 731 local tax jurisdictions across the state collecting an average local tax of 3681. Year-to-date sales tax revenues are down -38 compared to budget through April 2020.

Skip to Main Content. Page 2 of 93. You can print a 81 sales tax table here.

The December 2020 total local sales tax rate was also 8100. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. 072020 - 092020 - PDF.

27969171 BUDGET JANUARY FY 2020. Statewide salesuse tax rates for the period beginning July 2021. ACTUAL JANUARY FY 2020.

The minimum combined 2022 sales tax rate for Springfield Missouri is. Statewide salesuse tax rates for the period beginning October 2021. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax.

Special taxing districts such as fire districts may. 052020 - 062020 - PDF. 072021 - 092021 - PDF.

The City heavily relies on sales tax revenues as its main source of comes from sales tax and use tax-39 ACTUAL MARCH FY 2020. The City heavily relies on sales tax revenues as its main source of comes from sales tax and use tax. Missouri has recent rate changes Wed Jul 01 2020.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. 042021 - 062021 - PDF.

052021 - 062021 - PDF. Sales Tax Rate 0000 Use Tax Rate 0000 Food Sales Tax 1001 Food Use Tax 1001 Domestic Utility Rate 3200 MFG. 27356548 General Fund 1 Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual 22485.

Change Date Tax Jurisdiction Sales Tax Change Cities Affected. Mogov State of Missouri. 2022 Missouri state sales tax.

35729310 BUDGET MARCH FY 2020. For metropolitan and nonmetropolitan area definitions used by the OEWS survey see the metropolitan and nonmetropolitan area definitions page. 27969171 ACTUAL JANUARY FY 2019.

Compared to budget through March 2020 to budget. CAM-MO AMBULANCE DISTRICT GREENVIEW CID 00000-029-002 69750 54750. 102020 - 122020 - PDF.

Did South Dakota v. Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. Total Sales Tax Rates.

The Springfield sales tax rate is. Single-family home is a 3 bed 20 bath property. Indicates required field.

Exact tax amount may vary for different items. Average Sales Tax With Local. The base sales tax rate is 81.

There is no applicable special tax. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

Statewide salesuse tax rates for the period beginning July 2020. Single-family home is a 3 bed 20 bath property. Statewide salesuse tax rates for the period beginning May 2021.

Cities and counties may impose a local sales and use tax. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Statewide salesuse tax rates for the period beginning October 2020.

This is the total of state county and city sales tax rates. City Sales Tax City County and State taxes Knoxville TN. 31 rows With local taxes the total sales tax rate is between 4225 and 10350.

Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address.

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

Missouri Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Use Tax Web Page City Of Columbia Missouri

Colorado Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Missouri Sales Tax Small Business Guide Truic

Michigan Sales And Use Tax Audit Guide

How To Calculate Sales Tax Video Lesson Transcript Study Com